White Paper NEW! – Read our latest industry article ‘The future of technology in financial services’ by Enginef

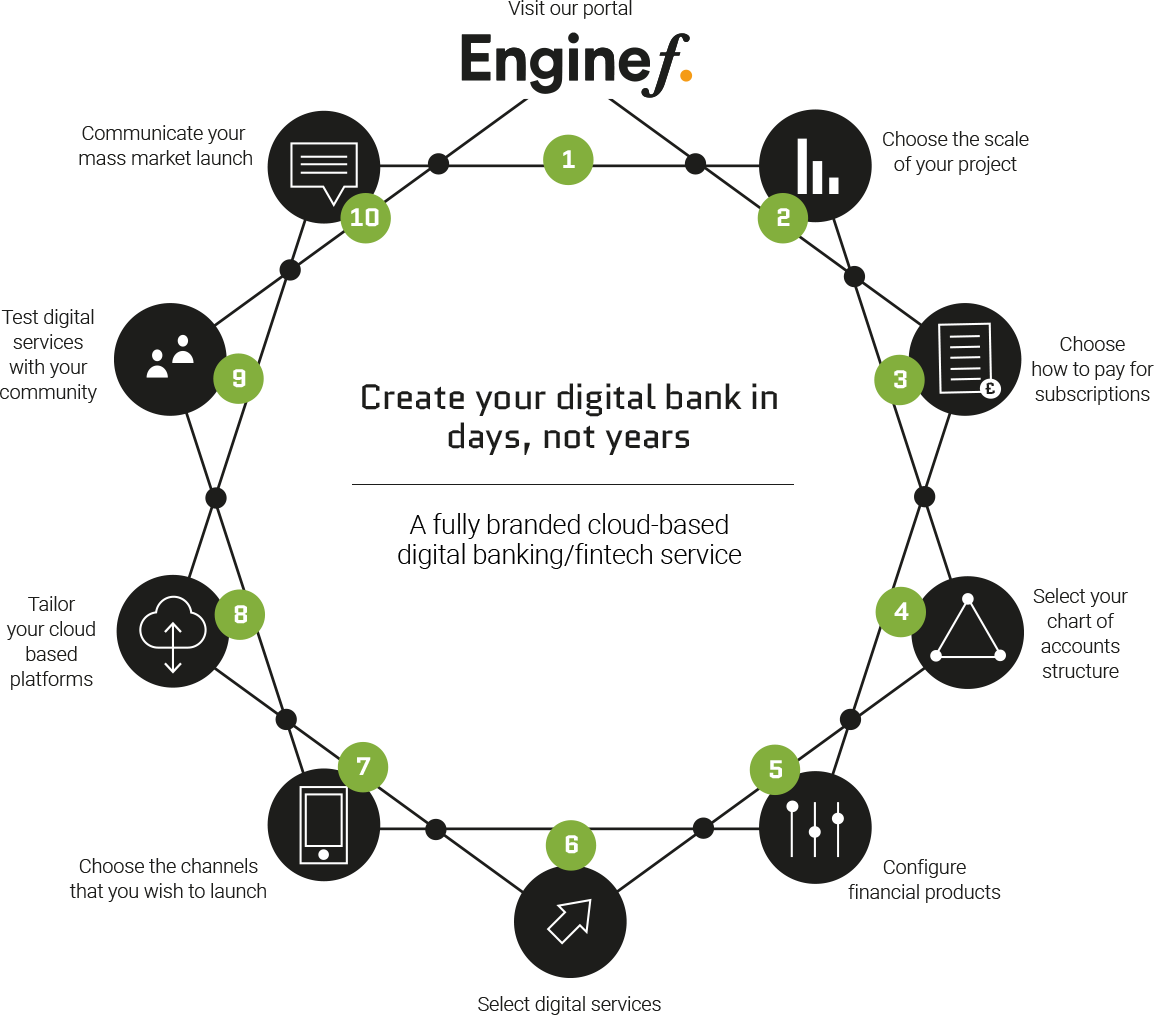

Our Banking Hub Solution

The Enginef Banking Hub is a groundbreaking Cloud Banking Saas Solution that has resequenced the DNA of digitised financial services. Incredibly fast, secure, agile, and painlessly simple open banking technology, the Banking Hub allows you to offer your customers the customer first banking services they demand.

Banking Hub – Uncovered

A fully integrated Cloud Banking Saas Solution that supports the ability to configure and customise the entire range of customer first banking services covering:

Any Product

Any Country

Any Service

Any Channel

Any Customer

Any Process

Any Segment

Any Rules

Fully Integratable Solutions

We deliver agile and expandable banking technology to support customer-first digital banking transformation. The Banking hub works as the middleware across a wide range of systems, services, APIs, Apps, partners & industry sectors

Customer Experience

Ensure a seamless user experience both for internal operations and external customer services, for your workforce, customers and clients. Easy to use, intuitive and effective.

Collaboration

Collaboration is at our core, our solution breaks down silos and harnesses the power of data and a connected digital ecosystem to transform your business.

Low Code Configurability

Using low code we achieve a truly fit for purpose technology, for all facets of your business. Our Digital Business Modeller enables you to configure the solution to your exact requirements.

Integration agility

Integrate to any number of internal and external services via APIs as required. Centralise and remove legacy.

Scalability + the Cloud

Having the ability to future proof your business is key — our solution is cloud based and truly scalable, it will grow with your business and customers.

Performance throughout

Tested at 14,000 Transactions per Second (3x VISA’s entire processing volume across 400m cardholders in Europe on the busiest shopping day of the year).

Underpinned by our agile cloud based frame work

Banking Hub core benefits

Real-Time Multi-Currency

Banking Hub provides unparalleled and highly configurable support for multi-currency transaction processing enabling:

Interest Accural

At the heart of any core banking system lies the ability to calculate interest. The Banking Hub like any established credible banking system provides the ability for sophisticated interest calculations.

Unlike many banking systems that were designed decades ago, Banking Hub represents the next generation of banking which supports traditional and modern interest and profit rate (shariah finance) calculation capabilities including:

Registration KYC AML Sanctions

At the heart of a digital solution for financial services sits a streamlined and configurable customer on boarding and registration capability. Banking Hub provides a highly efficient, fully digital and paperless means by which customers can register and as part of that registration process, comply with constantly evolving KYC, KYB, AML, PEP, Sanctions and other regulatory and financial-crime mitigation mechanisms.

The Banking Hub platform has been created to anticipate and respond quickly to ever changing regional and international policies and regulatory expectations. Banks, non-banks, startups and FinTech’s benefit from Banking Hub’s ability to support different national and customer segment requirements on one common platform.

PSD2/Open Banking

In a digital world where increasingly more and more services are becoming open via APIs, Banking Hub is a solution that embraces such initiatives and itself goes above and beyond what is required by regulations to enable open access to every feature, product and service that the technology offers.

Banking Hub can support a wide range of requirements spanning:

E-Money Institution as a Service

Enginef is able to offer an e-money license across Europe and via partnerships elsewhere enabling companies and new digital banks / non-bank financial entities to receive, manage and disburse client money/funds.

The Banking Hub platform has been created to anticipate and respond quickly to ever changing regional and international policies and regulatory expectations.

Banks, non-banks, startups and FinTech’s benefit from Banking Hub’s ability to support different national and customer segment requirements on one common platform.

Security & Authentication

In a world of constant threats from Cyber security and financially motivated crime and account takeover threats, Enginef has invested in a number of measures to minimise / mitigate the inherent risks that the whole industry faces from cyber criminals and denial of service disruption.

Security measures have been implemented, in accordance with latest thinking and ISO standards to protect customer access, infrastructure and data coupled with ongoing testing and certification management.

Further details can be made available on request under security-specific enhanced NDA / contractual confidentiality provisions.